What is management accounting?

For any business to continuously grow, a proper communication is crucial. All the stakeholders that manage respective processes in a business set up must communicate with each other to stay aligned with the organisation’s overall objective. Managerial accounting is nothing but the practice of identifying, measuring, analysing, interpreting, and communicating financial information to managers. It is different as compared to financial accounting as management accounting only assists the individuals with information related to costs of products or services purchased by the company and budgets to assess the operational efficiency to make informed decisions. In fact, management accounting use performance reports like financial reports to analyse the variances between actual results from budgets.

How managerial accounting works?

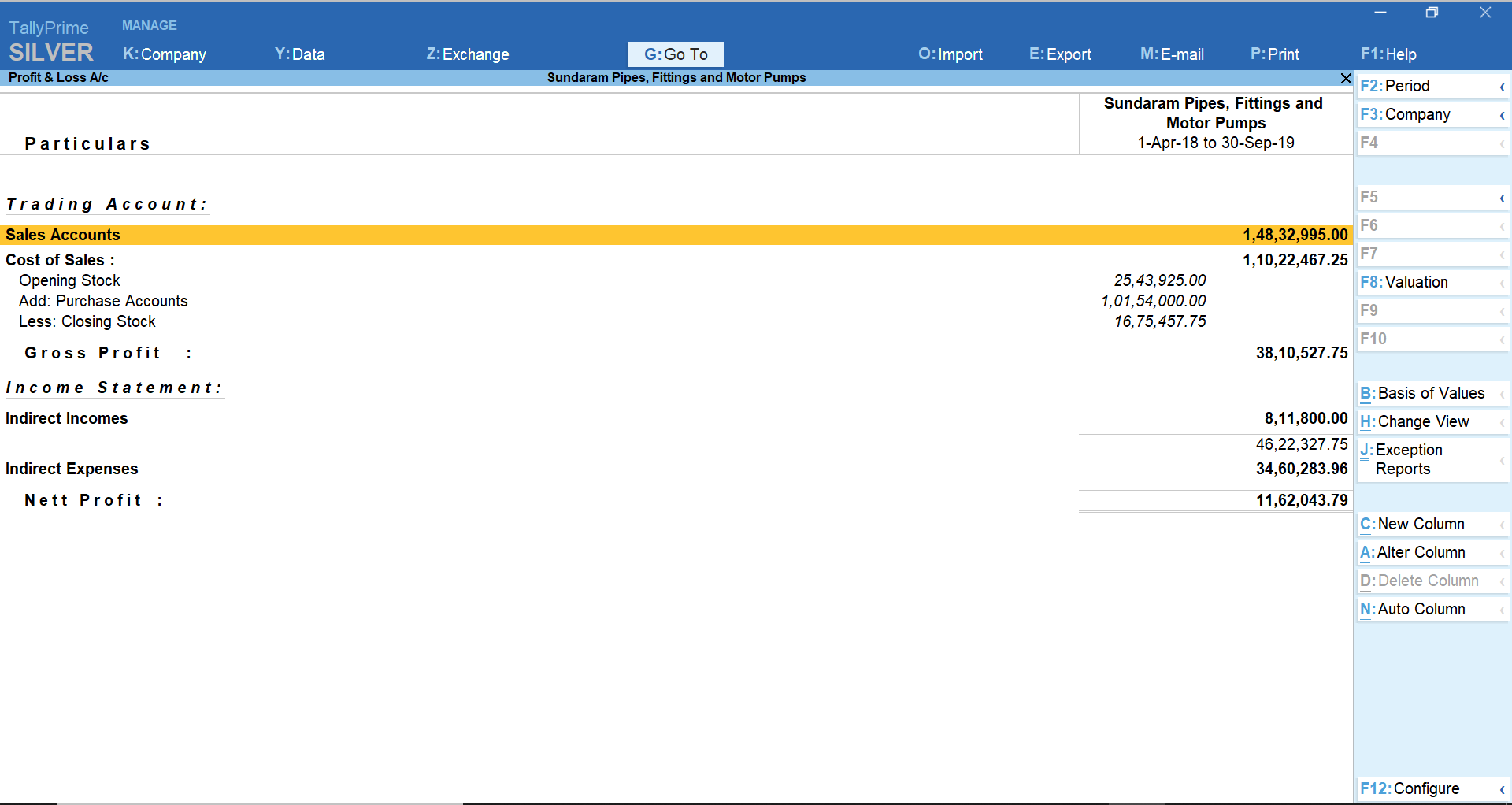

As stated before, managerial accounting uses various accounting and financial reports to derive to some major decisions which would impact the organisation’s growth. It goes through several steps of accounting that aim at providing relevant and accurate information to the management authority to understand and analyse business operation metrics better. Managerial accountants use data related to the cost of goods sold and sales revenue generated by the company for goods and services. Cost accounting is nothing but a subgroup of management accounting which primarily focuses on identifying and capturing the total production costs by evaluating the variable and fixed costs of each production step. This helps organisations in faster decision-making and eliminate spending unnecessary time and effort in other processes.

Types of managerial accounting

Since managerial accounting is all about analysing and identifying financial status of an organisation to take key business decisions, it is crucial for managers to refer to some crucial financial reports to derive at a conclusion. Let us look at the reports which help business managers help in faster decision making:

Budget reports

A budget is a plan prepared for the flow of funds in an organisation. It contains financial guidelines for the future plan of action for a selected period of time. A budget helps refine goals and use funds efficiently. It provides accurate information for evaluation of financial activities, aids in decision making and provides a reference for future planning. Since budget allocation is an ongoing process, your business management software must be flexible enough to allow you to modify/delete budgets as per your current/future plans. You should also be able to create Budgets for Banks, Head offices, Departmental budgets like Marketing Budgets, Finance Budgets, and so on, which will further help you assess relevant information with respect to company’s finances.

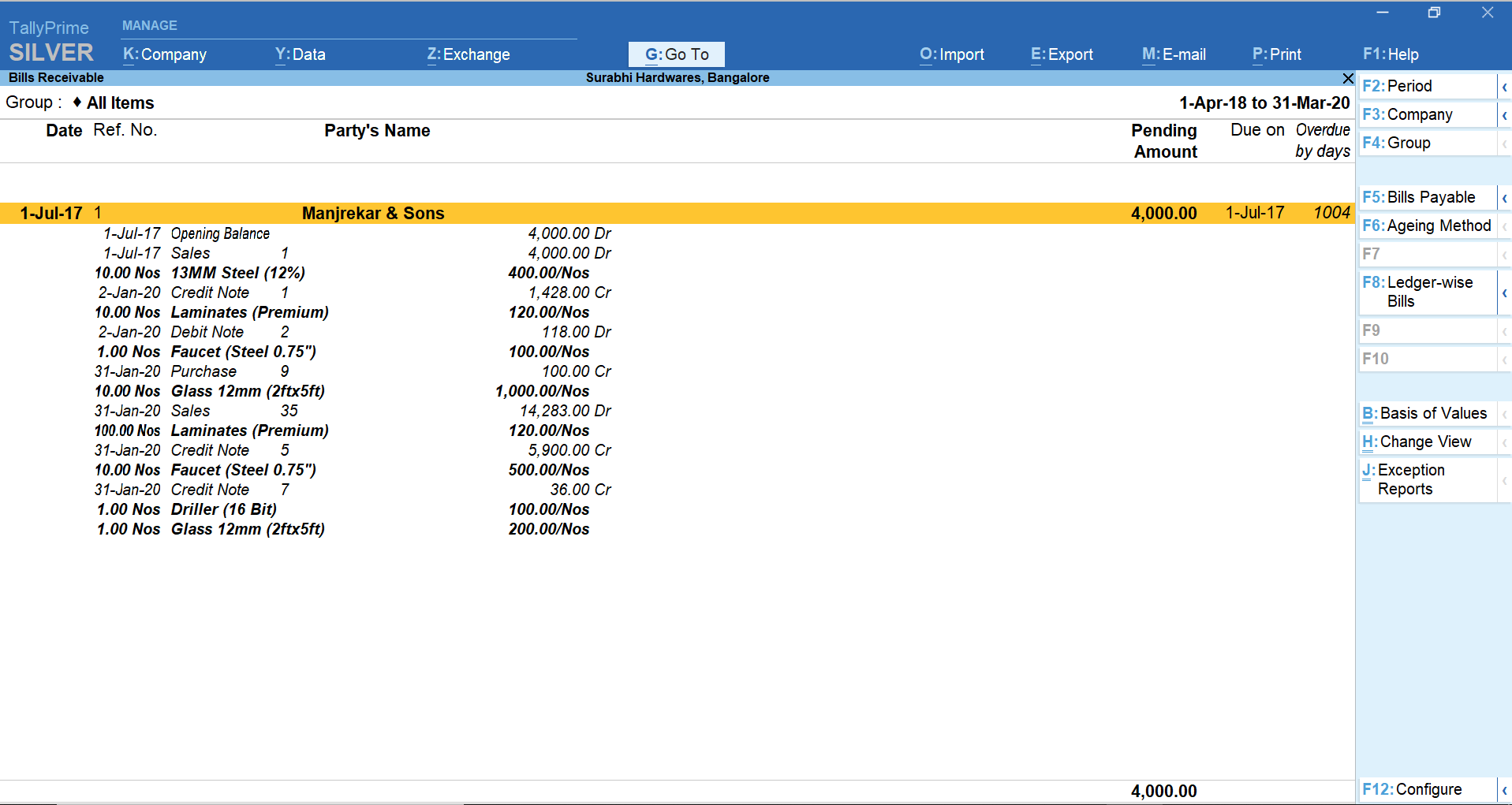

Accounts receivable and age-wise analysis reports

Management of receivables refers to planning and controlling of debt owed to the customer on account of credit sales. In simple words, successful closure of your order to sales is determined only when you convert your sales into cash. Till your sales are converted into cash, you need to manage ‘how much you need to receive? from whom? And when? To do this, you need accounts receivables management, popularly known as a credit management system in place.

Another reason, accounts receivables are one of the key sources of cash inflow and given the volume of credit sales, a large amount of money gets tied-up in accounts receivables. This simply implies that so much of money is not available till it is paid. If these are not managed efficiently, it has a direct impact on the working capital of the business and potentially hampers the growth of the business.

Ageing analysis of bills outstanding is done to identify the bills for which amount is due for a long period of time. These bills can be classified as bad debts or provisions can be created for such losses in the books of accounts depending on the results of ageing analysis. If there are too many defaulters who fail to pay the money, they owe you, then the company may need a much more stringent process with tighter credit policies to ensure optimum cash flow. If late payments become habitual to businesses/individuals, it may have a negative impact in your business eventually. Thus, it is imperative to know who owes you what.

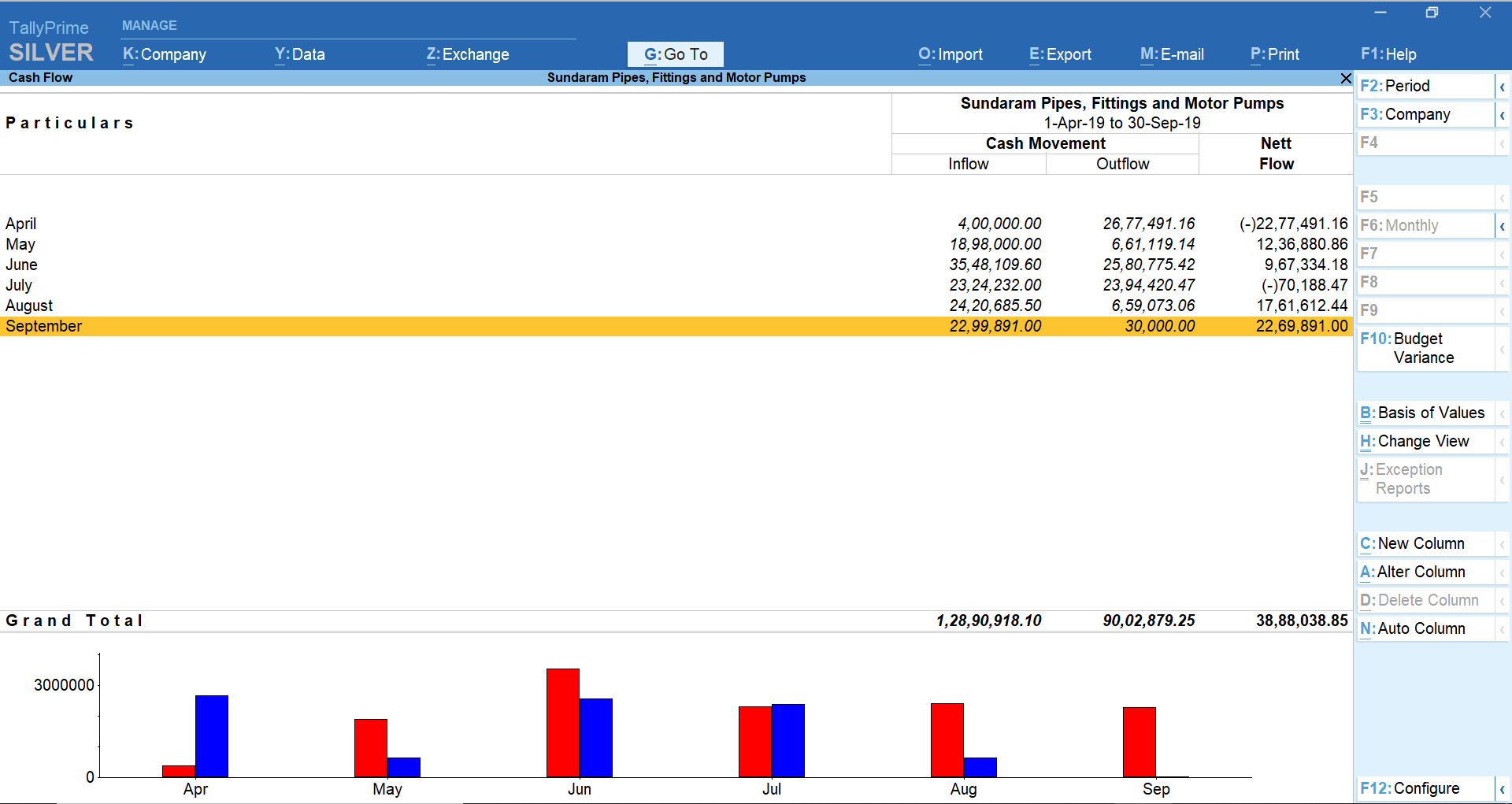

Cash flow analysis

Cash flow analysis report is referred to by business managers to understand the cash impact of various business decisions. Based on this analysis, a managerial accountant can plan and implement working capital strategies to maximise profits for the business and maintain a steady cash flow for prolonged sustenance. This also helps ensure there are enough liquefiable assets with the organisation in order to meet its short-term obligations. It is important to note that a managerial accountant only studies and analyses the cash flow report of cash in flow and outflow only of a certain period and business decision. This comparison is important as it will fetch the required information of how much the company has spent/gained/lost of a particular action that was taken so that the same isn’t repeated in the future.

Read to know how to calculate cash flow in TallyPrime

Also read: 6 tips for efficient cash flow management

Inventory turnover analysis

Inventory turnover ratio is an accounting ratio that establishes a relationship between the revenue cost, more commonly known as the cost of goods sold and average inventory carried during the period. It is also called a stock turnover ratio. Inventory turnover ratio explains how much of stock held by the business has been converted into sales. In simple words, the number of times the company sells its inventory during the period. A high inventory turnover ratio implies that a company is following an efficient inventory control measures compounded with sound sales policies. It explains how successful you are in converting the stock into sales. The higher ratio here is a positive sign for any business.

Read Inventory Valuation to know the different valuation methods and calculations with examples.

Functions of Management Accounting

Management accounting helps decision-makers in several ways. Referring, analysing, interpreting and concluding various derivatives from various financial reports aids business pursue their business goals and measure their possible outcomes and prepare for unprecedented situations. From forecasting the future of a business to where, when, what and how much to invest, these reports come in handy to managerial accountant when making key decisions that could make/break a business.

This process of preparing reports about business operations also help forecast cash flows and their impact in the long run. Managers can plan their strategies as they’d have an understanding and predict the revenue source and also know where the company will incur additional expenses from. Using analytical techniques, a managerial accountant can also assess performance discrepancies and run a comparative analysis between two periods to identify and conclude why, what went wrong.

Another vital question that gets answered with the help of management accounting is the rate of return. A business owner is well aware of the rate of return that his/her business would receive when investing in a project. From how much profit will the business earn to how many years will a company break even on a project to what are the cash flows estimated to be, such information will be easily available for sound decision making.

Setting up an automated business process would eliminate any room for inaccuracies and discrepancies. Implementing a business management software to generate various financial reports like; profit and loss, cash flow, stock ageing analysis, receiver turnover, etc. will help your managerial accountant become more attentive and analytical. TallyPrime not only fetches you these reports, but also lets you modify, compare, analyse and do much more based on your needs. Take free trial right away, and make the most of the software for the future of your business.

Comments

Post a Comment